Peer-to-peer lending is like a fresh way of handling loans, skipping the usual bank routes. This way, people looking for loans might snag some cash fast, and those with extra funds could see a nice payoff.

Here’s how the dance goes: People wanting loans sign up on peer-to-peer platforms. On the other side, folks with money to invest pick out loans that seem like a safe bet. Investors can put their money into a piece of one loan or spread it across a bunch. Borrowers end up with cash from a bunch of individual money heroes.

We’re going to dive deeper into these peer-to-peer lending platforms, how they work, what are the risks and rewards in crowdfunding loans, and figure out how you should invest in them.

What is Peer-to-Peer Lending?

Peer-to-peer lending is like a virtual marketplace where regular people can lend money directly to other individuals or businesses, cutting out the traditional banks. This happens through online platforms that connect lenders with those looking to borrow.

In this lending setup, you have two types of loans: secured and unsecured. Secured loans are pretty rare and usually involve valuable items as collateral. However, the majority of loans in peer-to-peer lending are unsecured personal loans, meaning there’s no specific asset tied to the loan.

Think of peer-to-peer lending as a unique way for everyday folks to help each other out financially, whether it’s for personal needs or business ventures. It’s like a lending community where people can connect online and support each other’s financial goals.

How Does P2P Lending Work?

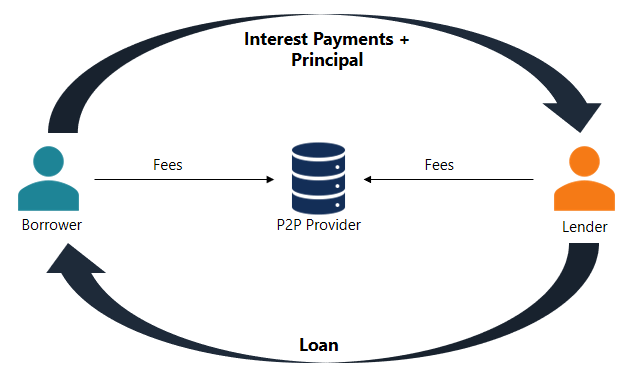

Peer-to-peer (P2P) lending is like matchmaking for money matters. It connects people who need a loan with those who want to invest and earn some interest. Here’s how it works:

Imagine you need a loan. You share your loan request on a P2P platform. Now, folks who want to invest and make some money check out these loan requests. They compete to fund your loan, and in return, they get interest.

The P2P platform takes care of everything – checking how reliable borrowers are, handling loan payments, and dealing with collections. If you’re an investor, you start by creating a profile and sending money to the platform. On the other side, if you’re looking for a loan, you share your financial info, and the platform rates your risk. This rating decides the interest rate you’ll pay.

Now, here’s the cool part: as an investor, you get to choose which loans you want to fund based on their risk and reward. Once the loans are funded, borrowers start paying back, and you start earning interest.

So, what makes P2P lending different from traditional banks? It’s quicker, more convenient, and easier to get into. P2P platforms offer flexible terms because they aren’t tied down by the strict rules that banks have to follow. It’s like a friendlier, more accessible way to borrow and invest money.

What are the Benefits of P2P Lending?

Jumping into P2P lending can be a win-win: it can amp up the earnings for folks lending out their money and cut down on interest rates for those borrowing. But, fair warning, it’s not a total walk in the park.

You’ve got to put in more time and effort, and there’s a bit more risk involved. So, let’s dive in and explore the benefits of P2P lending:

Credit Access for Everyone:

P2P lending is like a helpful hand for those who might face challenges getting a loan from regular banks because of their credit history. It opens up a new avenue for individuals or businesses with not-so-perfect credit backgrounds.

Better Interest Rates:

Borrowers often snag loans with really competitive interest rates. Sometimes, they’re even lower than what traditional banks offer. The interest rate is based on how trustworthy the borrower seems.

Smart Investments:

If you’re an investor, P2P lending lets you spread your money across various loans. It’s like having your eggs in different baskets. This not only lowers the risk but also boosts the chance of getting good returns on your investments.

Easy-Peasy Platforms:

The websites where all this happens are super user-friendly. Whether you’re looking to borrow or invest, these platforms make the whole process a breeze. It’s like the user-friendliness of your favorite apps but for borrowing and investing.

What are the Potential Returns and Risks Associated with P2P Lending?

When you engage in P2P lending, your earnings come from the interest rates you either set or agree upon. These rates can vary depending on the level of risk you’re comfortable with. Keep in mind that higher interest rates often mean a greater risk of losing your investment.

Apart from the risk of losing money, there are three other main concerns with P2P lending:

Possibility of Not Getting Expected Returns:

If a borrower repays your loan earlier or later than expected, it could affect your profits. Your money only starts earning interest once it’s lent out, not while it sits in your P2P account waiting for borrowers. Finding a borrower might take a few days, or even longer if you’re investing a significant amount.

Risk of P2P Platform Closure:

P2P platforms can go out of business, as seen with the collapse of UK firm Lendy in 2019. These platforms, being relatively new, haven’t been tested by severe economic downturns or major market disruptions. To address this, the Financial Conduct Authority (FCA) requires P2P lending platforms to keep lenders’ money in separate accounts to protect them in case the platform shuts down.

Challenges in Withdrawing Money Early:

While many P2P lending platforms offer the option to withdraw money early, it might not be available immediately, and there could be associated charges or interest. It’s essential to carefully read the terms and conditions to understand any limitations or fees associated with early withdrawals.

In summary, P2P lending comes with potential risks related to returns, platform stability, and early withdrawals. It’s crucial to be aware of these factors and thoroughly review the details before making investment decisions.

The more risk you’re okay with, the more you might get back from your P2P lending adventure. Now, we measure this risk using two things: first, how good the person borrowing your money is at paying back (creditworthiness), and second, how long you’re lending your money out.

Here’s the scoop – if you’re cool with lending for a longer time, you could see higher returns. And, if the person you’re lending to isn’t exactly a financial superhero (poor credit history), you might also get a bit more in your pocket.

But, here’s the twist: there’s no one-size-fits-all answer to how much you’ll make. Some P2P platforms throw out numbers like 12-14% returns for a year, but it’s not a guarantee for everyone.

Now, let’s talk about real numbers. When you’re counting your gains, remember two things: the chance that some borrowers might not pay you back (default rate) and the cut the platform takes for hooking you up with borrowers (platform fees). So, if you’re celebrating a 20% return but 5% of borrowers go MIA and there’s a 2% fee, your actual pocket gain is 13%. Keep your eyes peeled for the whole picture!

7 Tips for Investors Considering P2P Lending Platforms

People who put their money into peer-to-peer loans often talk about scoring big returns – like hitting double digits, ranging from 10% to a whopping 20% on certain platforms.

However, let’s not forget, there’s a flip side to this excitement. This guide is here for those who are eager to jump into the world of loan investing.

1. Spread Out Your Money:

To make the most of your peer-to-peer lending investments, it’s smart to mix things up. Instead of putting all your money into one borrower, consider spreading it across different borrowers and loan types. This way, you lower the risk of one borrower not paying back, and it gives you a better shot at earning steady returns. Think of it like not putting all your eggs in one basket.

2. Dig Deep into Borrower Backgrounds:

Before diving into a peer-to-peer lending platform, do a bit of detective work on the people asking for loans. Look for borrowers with good credit histories, stable incomes, and not too much debt. Some platforms spill the details about borrowers, like their credit score, job history, and what they need the loan for. Picking borrowers more likely to pay back can boost your chances of making more money.

3. Keep the Money Flowing:

Instead of cashing out your earnings, think about putting them back into new loans. It’s like planting a money tree. Reinvesting your earnings helps your initial investment grow faster because the interest you earned gets put back to work, making even more cash. So, if you’re getting monthly interest payments, think about plowing those funds into new loans to speed up your money-making journey.

4. Stay on Top of Things:

Keep a close eye on your peer-to-peer investments. Check-in regularly to see how borrowers are doing with their repayments and if anything’s changed in their money situation. Being an active manager of your investments means you can catch potential issues early on and do something about them. Some platforms have tools and alerts to help you keep tabs on your investments without it feeling like a full-time job.

5. Explore Your Options:

Some peer-to-peer lending platforms offer a kind of “used loan” market where you can buy or sell existing loans. It’s like a marketplace for loans. This feature lets you bail out of a loan early if you need to or snag loans with sweet deals. By taking advantage of these options, you can fine-tune your investment mix by ditching the underperformers and putting your money where it has more potential. Just be sure to carefully check out the loans available before making any moves.

6. Let the Robots Help:

If you don’t want to handpick each loan yourself, some platforms offer a nifty feature called auto-invest. You set the rules, like how long you want to invest and the kind of borrowers you’re into, and the platform does the rest. It’s like having a robot sidekick do the work for you, making sure your money gets spread around and saving you time from the manual picking process. Just remember to give your robot buddy a checkup every now and then to make sure it’s on the right track.

7. Learn from the Pros:

Boost your peer-to-peer lending IQ by checking out real-life stories and getting advice from the experts. Many platforms share stories about folks who made smart moves and earned good returns. And there are loads of online places where experienced investors spill their secrets and give guidance. Taking cues from others who’ve been there can give you some valuable tips to make your own investing journey smoother.

By mixing things up, doing a bit of detective work, keeping your money working, staying in the loop, exploring your options, letting robots lend a hand, and learning from the pros, you’ll be on your way to making the most of your peer-to-peer lending adventure.

Also Read: Diversified Investment Portfolios for Stable Returns

Bottom Line

Jumping into peer-to-peer lending isn’t everyone’s cup of tea. It could lead to a nice flow of profits, but there’s also the chance of taking a hit and losing a chunk of your investment. When you look at how much money usually rolls in, some folks might find it cozier putting their cash into stocks.

Over the last hundred years, the stock market has been serving up an average annual return of about 10%. What suits you best really boils down to how comfortable you are with risk, your goals, and what your wallet’s looking like.